The highway toll is the amount the Customer is required to pay for the use of the Highway.

Toll revenues are used to recover investments already made or to be made, to meet the costs of modernization, innovation, management and maintenance of the network and to recover the price paid in the event of sale or privatization procedures.

The toll is calculated on the basis of a journey without crossing any intermediate barriers.

Highway tolls may be collected under either the “closed” or the “semi-closed” type of collection system. The system is called “closed” when the customer collects the ticket at the entrance station to be handed in at the exit, so that the toll is determined, the amount of which is calculated according to the class of vehicle and the route taken as shown on the travel ticket.

The “semi-closed” system divides the highway into sections, each of which is controlled at a single point; consequently, it is no longer necessary to provide the customer with a ticket because the toll due at each station is independent of the actual origin and destination of the vehicle and varies only according to the tariff class.

TOLLS AT SEMI-CLOSED SYSTEM STATIONS

| Class A | Class B | Class 3 | Class 4 | Class 5 | |

|---|---|---|---|---|---|

| Cherasco | € 0,70 | € 0,90 | € 1,40 | € 1,90 | € 2,20 |

| Govone | € 2,70 | € 3,40 | € 5,50 | € 7,10 | € 8,30 |

CALCULATION AND METHODS OF PAYMENT OF THE TOLL

The highway toll is calculated as the product of the kilometers covered for each journey and the unit tariff of the Concessionaire, to which the surcharges and taxes envisaged by current legislation are added. The final toll amount shall be rounded up once to the nearest ten cents (DIM no. 10440/28/133 of 12.01.2001 by the Ministry of Infrastructure and Transport and the Ministry of the Economy and Finance). Rounding shall be applied automatically with no discretion by the Concessionaire.

The unit tariff is commensurate with the characteristics of the infrastructure (flat or mountainous) and the type of vehicle used according to the classification system currently in use, called axle-size.

Every year the tariff is adjusted according to the revision formula in force, by means of a Decree of the Ministry of Infrastructure and Transport in agreement with the Ministry of Economy and Finance, as established in the Standard Agreement between the Concessionaire and the Granting Body.

UKRAINIAN HUMANITARIAN EMERGENCY

As per Ordinance no. 876 of 13 March 2022 issued by Prime Minister’s Office, Department of Civil Protection, was ordered the toll exemption for Ukrainian citizens coming from Ukraine and for any person coming from Ukraine, entering the national territory as a consequence of the events taking place.

Such exemption will be valid within a maximum period of 5 days from the entry into Italian territory of those entitled.

When arriving at a motorway toll plaza exit of the undersigned Company, please use the manual Pay-toll collection gates, where a duly completed and signed self-certification must be delivered to the collector. The model can be downloaded, in both Italian and English language, by selecting the corresponding icons indicated below.

At the automatic Self-service gates, controlled by a remote monitoring operator, please collect the toll ticket and send it together with the self-certification model to e-mail address emergenzaucraina@asticuneo.it

TOLL PAYMENT METHODS

To pay the toll, it is possible to choose mobile systems such as Telepass or to use Viacard current account or prepaid toll card, credit cards or Bancomat cards belonging to the FastPay circuit.

All stations have installed automatic cash machines that can accept not only card payments, but also coins and banknotes in denominations between 5 cents and 100 euros.

All Asti-Cuneo stations are manned by Esazione personnel.

In highly automated stations, manual lanes are activated in exceptional cases.

EXEMPTIONS FROM THE PAYMENT OF HIGHWAY TOLLS

- Exempt by law

Pursuant to Art. 373 of D.P.R. of 16.12.1992, no.495 paragraph 2 and subsequent amendments, are exempt from the payment of the toll:

a) The vehicles of the State Police with “Police” plates and A.N.A.S. vehicles with identifying marks;

b) Carabinieri vehicles with “CC” license plates bearing a Ministry of Defense registration certificate with an endorsement to the Carabinieri Corps;

c) Vehicles with C.R.I. plates, as well as vehicles of voluntary associations and similar non-profit organizations, used for rescue in the performance of their specific service and provided with the appropriate identification mark approved by decree of the Minister of Transport and Navigation and Public Works;

d) Vehicles with V.F. plates, as well as those belonging to the permanent fire brigade of the autonomous provinces of Trento and Bolzano;

e) Vehicles with G.d.F. plates

f) Vehicles with C.F.S. plates.

g) Vehicles with PENITENTIARY POLICE license plates

h) Armed Forces vehicles used for rescue (ambulances, auto-rescue, etc.) in the performance of duty or as part of motorcades;

i) Armed Forces vehicles during emergency response and public disasters, as well as civilian vehicles, with Italian or foreign license plates, which, within the scope of bodies or organizations formally recognized by their respective States, carry out, following natural disasters or war events, transportation of basic necessities to aid the affected populations, provided they have specific certification from the competent authorities;

j) The vehicles of the officials of the Interior Ministry, of A.N.A.S., of the General Directorate of M.C.T.C., of the General Inspectorate for Traffic and Road Safety, of the Ministry of Public Works, authorized to the service of traffic police”.

Vehicles with CP (Capitaneria di Porto) license plates and mechanical rescue vehicles authorized by our Operations Center are also exempt from paying the toll.

- Voluntary Associations

Pursuant to Art. 373 of the D.P.R. of 16.12.1992 the vehicles of voluntary associations and similar non-profit organizations, used for rescue in the performance of their specific service and provided with a conforming identification, which must be visibly displayed on the front of the vehicle, are exempted from the payment of the toll.

In order for there to be a right to exemption, all the following conditions must be met at the same time as transit:

– The vehicle must be registered in the name of volunteer associations or similar non-profit organizations

– The vehicle must be used for rescue

– The vehicle must be engaged in the performance of the relevant specific service

– The vehicle must be provided with the appropriate identification

The memorandum issued by the Ministry of Public Works on 05.08.1997, no. 3973, the memorandum of the Ministry of Infrastructure and Transport of 18.09.2014, no. 378, as well as the note of the Ministry of Infrastructure and Transport, Structure for the Supervision of Highway Concessionaires of 02.10.2014, ref. no. 8758 have outlined the terms and methods for the specific applicability of the aforementioned regulatory provision, providing that the exemption in favor of voluntary associations operates exclusively for rescue/transportation in emergencies, as well as for non-emergency transportation of patients free of charge.

In the presence of these conditions, voluntary associations can choose to define the transit through Telepass system (a) or in another mode (b)

(a) The entire operation will be carried out using the specific web platform managed by Società Telepass e Autostrade per l’Italia, with reference to the provisions of the Memorandum of Understanding on the subject between all the Dealerships.

(b) Collection personnel shall be required to demand payment of the toll and, if not paid, a normal nonpayment report shall be issued. The voluntary association, if it believes that the transit is exempt, will have to ask the issuing Concessionaire, for the cancellation by declaring, under its own responsibility, the existence of all the above requirements. We specify that the non-payment report will also be issued if the vehicle transits without stopping at the toll booth.

NONPAYMENT OF TOLL

If the toll due (in whole or in part) is not paid, a non-payment report will be issued. The latter shows the vehicle data (class and license plate), the transit data (date, time, exit tollbooth and where available the entry tollbooth) and the amount to be paid.

The amount due may be paid, without any surcharge, no later than 15 days from the date of issue. If payment is made after the deadline indicated, the amount must be increased by € 2.58 for collection costs (art. 176/11 bis, New Highway Code).

If the nonpayment continues, the procedure for the forced recovery of the credit will be activated with the consequent increase in expenses for the debtor (art. 373 C.d.S).

In the event that the nonpayment report is issued for reasons not attributable to the customer, no surcharge will be applied to the toll due.

Finally, it should be noted that: “For a toll highway user without an entry ticket, or who engages the control facilities improperly with respect to the title in his possession, the toll payable shall be computed from the farthest station of entry for the class of his vehicle. The user shall be given the option of proof as to the station of entry.” (that Article 176 paragraph 16 C.d.S).

Payment can be made at:

– at service centers and in cash at partner highway stations

– all Post Offices by payment into postal account no. 85617942 made out to: AUTOSTRADA ASTI CUNEO indicating in the reason for payment the license plate of the vehicle and the number of the non-payment

– by bank transfer POSTE ITALIANE IT29F0760110400000085617942 BIC SWIFT BPPIITRRXXX CIN F payable to: AUTOSTRADA ASTI CUNEO S.p.A. indicating in the reason for payment the license plate number of the vehicle and the number of non-payment;

– online by credit card and/or Satispay, at the link https://www.asticuneo.it/a33-paga-online/ (accepted circuits: Visa, Mastercard, Diners, American Express).

In case of failure to pay the indicated amount, the relative acts can be transmitted to the Office of the Traffic Police Section responsible for the consequent contestation of the administrative sanctions as per art. 176/11° and 21° paragraph of the Highway Code for the ascertained violation of the obligation to pay the highway toll (which provides for the payment of a sum from € 87.00 to € 344.00 and the deduction of 2 points from the driver’s license of the actual offender).

For any further information the Toll Office can be contacted through:

Shared charge help number: 800.033.021

Email info@asticuneo.it

MULTUAL AGREEMENT FOR PAYMENT OF NONPAYMENT OF TOLLS

An agreement has been entered into between the listed Highway Concessionaires to facilitate the payment of Non-Payment of Tolls (RMPP), which can be carried out either at a toll booth manned by a collector, or at one of the Service Centers of the following Highway Concessionaires:

- A4 Turin-Milan

- A5 Turin-Ivrea-Quincinetto

- A5 Quincinetto-Aosta

- A6 Turin-Savona

- A7 Serravalle Milan

- A10 Savona-Ventimiglia-State border

- A11 Viareggio-Lucca

- A12 Sestri Levante-Livorno

- A15 Parma-La Spezia

- A21 Turin-Piacenza

- A32 Turin-Bardonecchia

- A33 Asti-Cuneo

- A35 Brebemi

- A50 Highway Bypass West of Milan

- A51 Highway Bypass East of Milan

- A52 Highway Bypass North of Milan

- A55 Turin bypass system

- A58 Outer Bypass East Milan

– Payment at Manual Toll Booth and/or at the toll booths by the Toll Staff

Only nonpayment reports (RMPP) with a date no more than 15 days from the date of issue and with a defined entry station may be settled in the manual toll booth. The Collector may not accept partial payments.

– Payment of RMPP at the Service Center

The payment of nonpayment reports (RMPP) can also be made at Service Centers, in which case those RMPP with an issue date greater than 15 days may also be settled.

TARIFF CLASSES

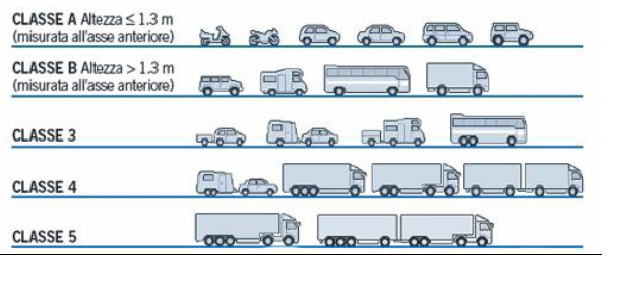

The vehicle fleet is divided into five classes using two parameters:

- “Height Gauge”, which is the height of the vehicle measured at the axis of the front wheels. This criterion is used to classify all two-axle vehicles, which are divided into two classes;

- “Axles,” meaning the number of axles of vehicle construction. With this criterion, all vehicles and trucks with three or more axles are classified into the remaining three classes. The five classes are defined as follows: